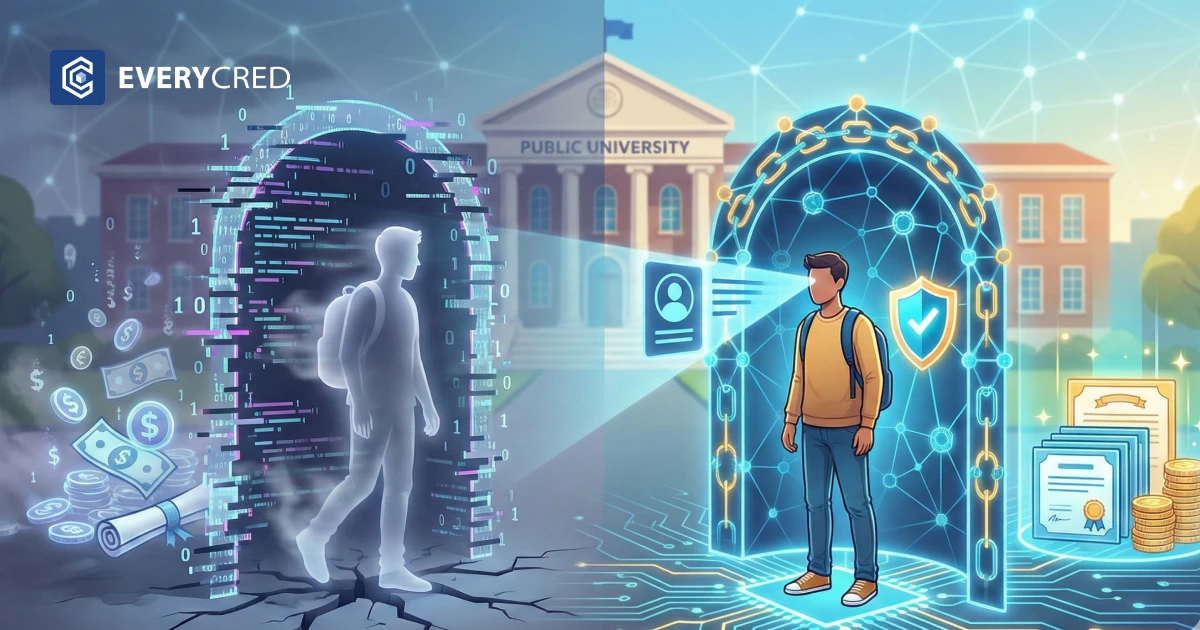

Public education agencies in the United States face a growing financial threat from synthetic identities. These fraudulent accounts, known as “ghost students,” exist only on paper or in digital databases.

Bad actors use these identities to enroll in schools and apply for federal financial aid. The U.S. Department of Education recently reported that it prevented over $1 billion in federal student aid fraud in 2025 alone.

Despite these efforts, ghost student fraud remains a systemic issue for education boards. Agencies must implement robust ghost student fraud prevention strategies to protect taxpayer funds and institutional integrity.

How Ghost Students Drain Public Funding

Ghost students are not real learners. They are fabricated personas created by combining stolen and fictitious data. Criminal organizations use these identities to exploit the “open enrollment” policies of many public institutions. Once enrolled, these fake students trigger the release of grants, loans, and stipends.

According to research, the Department of Education identified a $180 million problem involving ineligible students and the use of identities belonging to deceased individuals. This type of credential fraud siphons resources away from legitimate students who require assistance. In California, community colleges reported that nearly 20% of their applications were fraudulent in a single academic year. This volume of ghost student fraud overwhelms manual verification teams and delays processing for actual applicants.

The Anatomy of Synthetic Identity: How Fake Credentials Enter the System

Fraudsters no longer rely on simple forgeries. They use artificial intelligence to generate fake credentials that appear legitimate to traditional screening systems. These include realistic high school diplomas, transcripts, and government IDs. When an education board lacks a secure digital identity verification system, these documents often pass as authentic.

Synthetic identity fraud is particularly difficult to detect. A criminal may use a real Social Security number belonging to a minor or a deceased person and pair it with a fake name and address. Because parts of the data are real, the identity may pass initial automated checks. This complexity makes ghost student fraud prevention a priority for modern education administration. Without advanced digital identity verification for education, these “ghosts” remain on the books, consuming per-pupil funding and distorting enrollment data.

Why Ghost Student Fraud is an Institutional Threat

The presence of ghost students creates multiple layers of risk for public agencies:

- Financial Loss: Agencies lose state and federal funding allocated to non-existent students.

- Regulatory Non-Compliance: Failure to prevent credential fraud leads to audits and potential penalties from the Office of Inspector General (OIG).

- Operational Strain: Administrative staff spend hundreds of hours investigating suspicious accounts instead of supporting student success.

- Data Inaccuracy: Fraudulent enrollments skew graduation rates, attendance records, and performance metrics.

Education boards must recognize that academic credential verification is now a front-line defense against financial crime.

Why Traditional Verification Fails

Many public education agencies still use manual processes. Staff members often verify paper documents or PDF scans by contacting the purported issuer via email or phone. These methods are slow and prone to human error. Furthermore, they cannot easily detect high-quality fake credentials generated by AI.

The U.S. Department of Education has urged institutions to adopt higher standards. In a 2025 press release, the Department emphasized the need for enhanced fraud controls to stop international fraud rings and automated bots. Relying on legacy systems allows ghost student fraud to persist because these systems do not provide real-time validation.

Strengthening Ghost Student Fraud Prevention

To stop these losses, agencies must shift toward an “Identity Trust” model. This model requires that every applicant proves their identity through a secure, cryptographic process. Effective ghost student fraud prevention involves matching application data against authoritative third-party sources in real-time.

Education boards can implement blockchain-based credential verification to ensure that a student’s history is tamper-proof. By using this technology, an agency can verify a student’s prior achievements without the risk of encountering fake credentials.

Comparison of Verification Methods

| Feature | Manual Verification | Digital Identity Trust |

| Speed | Weeks or months | Seconds |

| Accuracy | High risk of human error | Cryptographic certainty |

| Detection | Limited for synthetic IDs | Flags behavioral anomalies |

| Scalability | Requires more staff | Handles thousands of apps |

| Fraud Risk | Vulnerable to credential fraud | Highly resistant |

The Digital Trust Layer: Verification Strategies for Modern Enrollment

A modern digital identity verification for education system uses several layers of security. First, it utilizes document forensic analysis to check for signs of digital tampering. Second, it employs biometric “liveness” checks to ensure the applicant is a real person rather than an AI bot.

Implementing verifiable credentials in higher education allows students to own their data. They carry a digital wallet containing their verified IDs and transcripts. When they apply to a new program, the agency verifies these records instantly. This process eliminates the window of opportunity for ghost student fraud because the credentials link directly to an immutable source.

How Agencies Can Implement Better Controls

Education boards should follow a structured approach to modernize their enrollment systems.

- Audit Current Systems: Identify where manual data entry occurs and where fake credentials might enter the workflow.

- Adopt Open Standards: Use frameworks like the W3C Verifiable Credentials standard to ensure different systems can talk to each other.

- Integrate API-Based Verification: Connect enrollment portals to a digital identity verification for education platform that provides instant feedback.

- Monitor Velocity: Track if hundreds of applications originate from the same IP address or use similar data patterns. This is a primary indicator of ghost student fraud.

By automating these steps, agencies reduce the administrative burden. They also ensure that certificate fraud prevention becomes a permanent part of the institutional infrastructure.

Eliminate Identity Risk with EveryCRED

The EveryCRED platform provides a specialized toolkit for education boards to combat ghost student fraud. The system uses the EveryCRED “evrc” Decentralized Identity (DID) method to create secure, individual identities for students. These identities are anchored on a blockchain, making them impossible to replicate or alter.

When an agency uses EveryCRED, it can issue and verify academic records with one click. This capability directly addresses credential fraud by ensuring that every diploma or transcript is cryptographically signed by the issuing authority.

Education boards can integrate EveryCRED’s API into their existing Learning Management Systems (LMS) or enrollment portals. This allows for seamless digital identity verification for education without requiring students to navigate complex new interfaces.

EveryCRED’s architecture supports Zero-Knowledge Proofs. This technology allows a student to prove they meet eligibility requirements, such as being a state resident or being over 18, without sharing their full birth date or address. This balances ghost student fraud prevention with strict data privacy compliance.

Conclusion

Stopping ghost student fraud requires a move away from paper-based and manual verification. Public education boards in the USA must adopt automated, cryptographic tools to protect their budgets and their students. By implementing a robust ghost student fraud prevention strategy and utilizing digital identity verification for education, agencies can eliminate the risks associated with fake credentials and credential fraud. These technological shifts ensure that public funds serve real students and support legitimate educational goals.

12th February, 2026

12th February, 2026