A state digital identity wallet is a secure mobile application that lets residents store and share government-backed digital credentials such as IDs, licenses, and permits using Verifiable Credentials under a clear legal, security, and governance framework. It enables trusted, privacy-preserving verification across agencies and private-sector partners while reducing fraud and friction in public services. For 2026 programs, governments should focus on a small set of high-impact use cases, align with open standards, choose an architecture reference framework, and roll out via pilots before scaling statewide.

Why Digital Identity Wallets Matter for States in 2026

From a founder and architecture point of view, digital identity wallets have shifted from “innovation pilots” to core state infrastructure on par with payments rails and civil registries. The question for 2026 is no longer if a state will launch a wallet, but how to do it in a way that is secure, interoperable, and politically safe.

The industry is moving from siloed logins and scattered databases to government credential wallets and mobile IDs built on Verifiable Credentials. This shift allows a resident to prove “who I am,” “what I’m entitled to,” and “what I’m allowed to do” with a few taps on a phone, instead of re-entering data and presenting paper documents at every touchpoint.

The stakes are high. A failed rollout damages citizen trust, invites political scrutiny, and can set digital government back years. A successful rollout, on the other hand, can cut fraud, reduce administrative overhead, and make digital access to services feel as simple as using a modern banking app.

What is changing in 2026 is not just technology but expectation: regulators and citizens increasingly expect mobile ID, data minimization, strong customer authentication, and cross-border or cross-jurisdiction interoperability as standard. A wallet is becoming the front door to digital state services.

Most conversations obsess over “the wallet app,” but the real leverage is in the credential ecosystem and trust framework behind it—issuer/holder/verifier roles, revocation registries, PKI, policy, and ecosystem governance. The app is just the visible layer.

The quick win for most states is not a grand, all-encompassing platform; it is a minimum viable wallet focused on a handful of high-value use cases, powered by a platform like EveryCRED that handles Verifiable Credentials, interoperability profiles, and lifecycle management behind the scenes.

Core Building Blocks of Government Digital Identity Wallets

What Is a Digital Identity Wallet for States?

A digital identity wallet is a secure mobile or web-based application where residents can receive, store, and present digital credentials issued by the state and trusted partners. Think of it as a government-backed “credential container” that sits on the citizen’s device, not just another login or PDF viewer.

Unlike a single-purpose app, a state wallet is designed to support multiple credentials—identity, licenses, permits, benefits using common rails. It plugs into a broader trust framework so that verifiers (agencies and private relying parties) can trust what they see.

Verifiable Credentials in Government Language

Verifiable Credentials (VCs) are digitally signed statements about a subject (for example, “Jane Doe holds a valid driver’s license until 2029”) that can be issued, presented, and cryptographically verified. In plain terms, a VC is like a digital certificate with built-in authenticity and integrity.

In a government context, agencies act as issuers, residents as holders, and services such as banks, universities, or other agencies as verifiers. Instead of sending PDFs or images, the holder presents a structured, signed VC that a verifier can check against a trust framework or registry.

Gov Credential Wallet vs Mobile ID vs eID

A government credential wallet is the general-purpose container that can hold multiple digital credentials from various issuers. A mobile ID is typically a high-assurance credential (e.g., a digital version of a national ID or driver’s license) that can live inside that wallet.

Traditional eID programs often focus on authentication and login, while a wallet plus Verifiable Credentials approach adds fine-grained claims (age, residency, license category) that can be selectively shared. These are complementary, not mutually exclusive—many states will layer wallets on top of existing eID or CIAM systems.

A Simple Analogy for Non-Technical Stakeholders

Picture a secure folder on a resident’s phone. Government agencies can drop sealed envelopes into that folder—each envelope is a Verifiable Credential containing a signed statement like “This person can drive” or “This person is eligible for benefit X.” When the resident visits a service, they choose which envelope to show; the verifier opens it cryptographically, not manually, and instantly knows it’s genuine and unaltered.

In this analogy, decentralized identifiers (DIDs), PKI, and revocation registries are the locks and keys on these envelopes, ensuring only the right parties can issue, verify, or revoke them.

Key Concept Takeaways for State Leaders

In practical terms, a digital identity wallet is a citizen-facing app, while Verifiable Credentials and trust frameworks are the invisible rails that make the credentials inside that app verifiable and reusable. Mobile ID and existing eID schemes can sit alongside this model, and a platform like EveryCRED provides the issuance, verification, and lifecycle capabilities so the wallet is never a one-off build.

How to Plan and Launch a State Digital Identity Wallet Program

Step 1: Define Policy, Scope, and Priority Use Cases

Start with policy and outcomes, not features. Decide which legal and regulatory frameworks apply (data protection, eIDAS-style rules, sectoral regulations) and what assurance levels you must support for different use cases.

Then shortlist three to five high-value use cases that can demonstrate impact: for example, mobile driver’s license, citizen login for key portals, benefits access, or education and professional credentials. Align these use cases with political priorities—fraud reduction, faster service delivery, or digital inclusion—so stakeholders see the wallet as an enabler, not as a risk.

Step 2: Choose Your Trust and Architecture Model

Decide how centralized or decentralized your model should be. Some governments will use a more centralized trust framework with strong PKI and central registries; others will adopt decentralized identifiers and more SSI-like patterns, especially where cross-border or cross-sector interoperability is a priority.

Select an architecture reference framework (ARF) that defines the roles of issuers, holders, verifiers, registries, and governance bodies. Ensure support for open standards (VC data models, DID methods where relevant, standardized interoperability profiles) to avoid tight vendor lock-in. This is where EveryCRED can serve as the standards-aligned backbone, allowing you to change wallet apps without redoing your credential infrastructure.

Step 3: Design the Credential Ecosystem (Issuers, Holders, Verifiers)

Map your ecosystem. Identify which agencies will be issuers for which credentials and which public- and private-sector organizations will rely on those credentials as verifiers. Include municipalities, banks, universities, and high-impact private relying parties that can drive adoption.

Define ecosystem governance: credential schemas and metadata, onboarding requirements for issuers and verifiers, revocation and suspension rules, audit trails, and liability. Decide how revocation registries and trust lists will be operated and how often they will be updated and audited. Clear rules here reduce risk and make RFPs much more concrete.

Step 4: Implement, Pilot, and Iterate

With use cases and ecosystem defined, implement a minimum viable wallet program rather than a whole-of-government big bang. Start with one or two credentials, a limited set of verifiers, and a tightly scoped region or population segment if appropriate.

Run a structured pilot program: measure citizen onboarding rates, error rates, support tickets, performance under load, and fraud signals. Use this data to refine UX, policies, and technical configurations before scaling.

Optional Advanced Steps

Once the basics work, add advanced capabilities: selective disclosure (only sharing age, not full date of birth), zero-knowledge proofs for privacy-preserving claims, and strong customer authentication flows that balance security and usability.

Integrate the wallet with existing CIAM systems and portals to reuse existing login flows while gradually moving high-value proofs (eligibility, attributes, licenses) to Verifiable Credentials. Where relevant, align with cross-border initiatives and interoperability frameworks so credentials can be reused beyond state boundaries.

What Success Looks Like in the First 18 Months

The practical path is: define policy and use cases, choose a standards-based architecture, map and govern your ecosystem, then pilot and iterate. EveryCRED can anchor this journey by providing an ARF-aligned credential and trust platform, so your team focuses on outcomes and governance rather than plumbing.

Common Pitfalls in Government Wallet Implementations

Mistake 1: Treating the Wallet as “Just an App”

Many programs overinvest in the citizen app interface while underinvesting in the trust framework, governance, and credential models behind it. The result is a shiny app that doesn’t scale across agencies or integrate with external verifiers.

Mistake 2: Big-Bang Rollout with No Pilot

A statewide launch without pilots creates enormous risk: unexpected performance issues, accessibility problems, and policy gaps surface in production, not in testing. This can stall adoption and harm the political credibility of digital government efforts.

Mistake 3: Vendor Lock-In and Proprietary Formats

Selecting a closed proprietary system that doesn’t support open VC standards or DIDs makes it difficult to extend the program, onboard new relying parties, or integrate with future frameworks. This drives long-term costs and reduces strategic flexibility.

Mistake 4: Ignoring Ecosystem Incentives

Wallet projects can fail not because the app is poor, but because banks, universities, municipalities, and agencies see no clear value in joining as verifiers or issuers. If ecosystem incentives and onboarding processes are not designed from the start, usage remains low.

Operational Lessons for Avoiding These Pitfalls

In practice, failed wallet programs are rarely about cryptography or code; they are about ignoring governance, ecosystem design, and controlled rollout. A platform like EveryCRED, paired with a governance-first approach, helps avoid these traps by enforcing standards and providing reusable patterns from day one.

Myths Holding Back Digital Identity Wallet Adoption

Myth 1: “Digital Wallets Replace Physical IDs Overnight”

In reality, physical IDs will coexist with digital identity wallets for years, especially in high-risk or low-connectivity scenarios. Forcing a hard cutover too early risks exclusion and backlash.

Myth 2: “Self-Sovereign Identity Means Government Has No Control”

Adopting DIDs and Verifiable Credentials does not mean giving up control over legal identity. The state still defines and issues authoritative credentials; citizens simply gain more control over how, when, and where they share them.

Myth 3: “Security = Making It Harder to Use”

There is a belief that secure digital identity must be complex for citizens. In practice, combining strong customer authentication, device security, and well-designed UX can make wallets both safer and easier to use than legacy login and paper-document flows.

How to Unblock Stakeholders by Debunking Myths

The fastest way to unlock momentum for a wallet program is to clear internal and external myths. When leaders see that physical IDs remain, that the government retains authority, and that security can be user-friendly, approvals and adoption become far easier to achieve.

Frameworks & Mental Models

“CRED: State Wallet Readiness Framework”

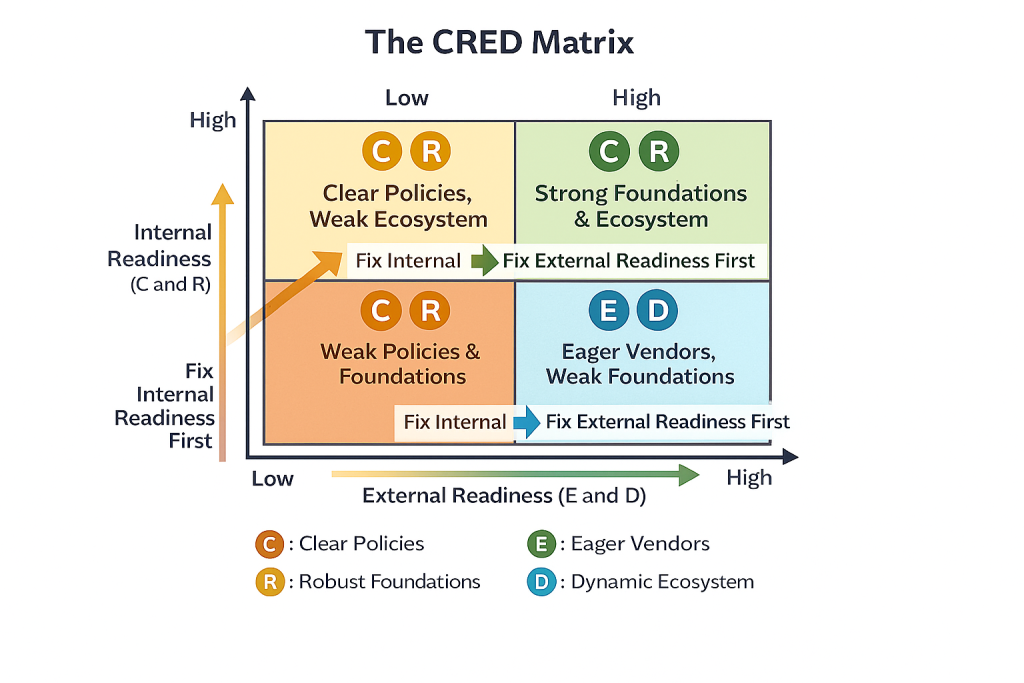

Use CRED as a simple diagnostic:

- C = Coverage: Have you defined the right mix of use cases, agencies, and credentials to justify the wallet?

- R = Risk & Regulation: Are legal, privacy, and security requirements clearly mapped, with data protection and eIDAS-style obligations understood?

- E = Ecosystem: Do you know which issuers, verifiers, and relying parties you must onboard and how you will incentivize them?

- D = Delivery: Do you have the technical architecture, vendor partners (such as EveryCRED), and pilot roadmap to deliver in 12–18 months?

Visual Breakdown

Visualize a 2×2 matrix: Internal Readiness (C and R) on one axis, External Readiness (E and D) on the other. High internal but low external readiness means your policies are clear but your ecosystem is weak; high external but low internal readiness means vendors and partners are eager, but your legal and governance foundations are not in place.

Plotting your state on this CRED matrix clarifies which dimension to fix first.

When to Apply the CRED Framework

Use CRED at the start of strategy cycles, during offsites, and whenever you update your roadmap. It is also a powerful way to structure RFPs: each CRED dimension becomes a section with explicit expectations for vendors and internal teams.

How CRED Shapes Your Wallet Roadmap

If your program scores low on any CRED dimension, you are not ready for a full statewide wallet rollout. Use CRED to decide whether to start with a narrow pilot, strengthen governance, or re-scope your ambition—then use a platform like EveryCRED to deliver against that focused plan.

Real-World Use Cases for State Digital Identity Wallets

Mobile Driver’s License and Mobile ID

A state DMV issues a mobile driver’s license as a Verifiable Credential into the resident’s digital identity wallet. When stopped by law enforcement or accessing age-restricted services, the resident presents a QR code or NFC tap; the verifier checks the VC signature and revocation status automatically, without storing unnecessary personal data.

Digital Access to Benefits and Social Services

A social services agency issues a VC that proves benefit eligibility. The resident uses their wallet to access housing support, healthcare subsidies, or transport discounts without repeatedly filling forms or re-proving income and residency. Verifiers see only what they need, reducing fraud and administrative overhead.

Education and Professional Credentials in the Wallet

Universities and licensing boards issue Verifiable Credentials for degrees and professional licenses. A resident uses the wallet to apply for jobs or grants that require proof of education and licensing, and employers verify instantly. No more chasing stamps, notarized copies, or email confirmations.

Patterns You Can Reuse Across Agencies

Across mobility, benefits, and education, the pattern is consistent: issue once, reuse many times, with clear revocation and governance. A platform like EveryCRED allows these scenarios to share the same Verifiable Credential rails, so each new use case is incremental, not a new project.

Old vs New: From Siloed ID Systems to Wallet-Based Infrastructure

Legacy Model: Portals, PDFs, and Repeated KYC

Today’s identity flows rely on login/password combinations, siloed CIAM systems, emailed PDFs, and visual inspection of physical documents. Each agency repeats KYC and eligibility checks, storing more personal data than necessary and opening multiple vectors for fraud and data breaches.

Wallet Model: Reusable, Verifiable Credentials

With a digital identity wallet and Verifiable Credentials, citizens prove identity and attributes using signed, machine-verifiable credentials. Agencies and relying parties verify authenticity in real time using trust registries and revocation lists, storing only the minimum necessary data. Reuse becomes the norm.

A Practical Migration Path for States

The transition should be evolutionary, not a cliff. Run legacy login and document flows in parallel with wallet-based flows, starting with high-volume, high-friction use cases where the value is clear. As adoption grows, progressively decommission legacy processes and tighten policies around reusable credentials.

What Changes for Agencies and Citizens

The old way treats every interaction as a new identity problem; the new way treats identity as reusable infrastructure. By planning a phased transition and using EveryCRED to bridge old and new, states can modernize without disrupting critical services.

Hidden Opportunity in Wallet-Based Government Identity

Real Barrier: Trust and Coordination, Not Technology

The real competition for your wallet program is not other vendors—it is citizen distrust, agency fragmentation, and initiative fatigue. If residents don’t trust the wallet or if agencies see it as “extra work,” technical elegance is irrelevant.

Why the Opportunity Is Bigger Than “Digital ID”

Wallets are often framed as “ID projects,” but they are, in reality, platforms for licensing, benefits, education, professional credentials, and cross-border mobility. Each additional credential and relying party increases the value of the network; a well-designed wallet can become the primary interface for digital state interactions.

Founder-Level Lessons from Early Government Programs

From a founder’s lens, the projects that succeed are those that treat wallets as long-lived infrastructure with multi-year roadmaps, not as one-off mobile apps. They start small but design for an ecosystem, not just for one “hero use case.” They choose partners like EveryCRED that commit to open standards and shared success, rather than selling lock-in.

How Visionary States Will Lead the Next Decade

States that think beyond “launching an app” and instead build an identity and credential ecosystem will define the next decade of digital government. The blue ocean is not another wallet—it is an interoperable, trusted layer that every agency and citizen uses daily.

Practical Tools and Checklists for State Identity Wallet Teams

Pre-Launch Readiness Checklist

Before launching, ensure you can answer yes to:

- Have we defined 3–5 priority use cases with clear, measurable outcomes?

- Have we mapped applicable regulations, assurance levels, and data protection requirements?

- Do we have a documented trust framework and ARF-style architecture?

- Have we identified key issuers, verifiers, and relying parties and how to onboard them?

- Do we have a pilot plan with clear metrics and a rollback strategy?

- Is our RFP explicit about open standards, interoperability, and avoiding lock-in?

Essential Tools and Platforms

Key categories of tools for a state wallet program include:

- Credential infrastructure platforms (like EveryCRED) for issuance, verification, revocation, and ecosystem governance.

- Wallet reference apps or SDKs to accelerate citizen-facing channels.

- Test harnesses and conformance testing tools to validate interoperability profiles.

- PKI, HSM, and key management services for secure signing.

- Monitoring, analytics, and fraud-detection tools to track ecosystem health.

Templates You Can Reuse Internally

Useful templates to accelerate decision-making:

- A one-page internal brief that explains the wallet concept, use cases, and roadmap to ministers and senior leadership.

- An RFP template that aligns requirements with the CRED framework (coverage, risk & regulation, ecosystem, delivery).

- A pilot playbook template outlining roles, metrics, communication plans, and citizen support.

How to Move from Concept Note to Pilot Quickly

With the right checklist, tools, and templates, a state can move from concept note to live pilot in months, not years. EveryCRED fits into this as the backbone for Verifiable Credentials and ecosystem governance, while your internal team focuses on policy, adoption, and citizen experience.

Wrap-up!

- Digital identity wallets and Verifiable Credentials are becoming core infrastructure for state governments, not side projects.

- Success depends more on governance, ecosystem design, and standards alignment than on building a single excellent app.

- A phased rollout, anchored on clear use cases and a CRED-style readiness assessment, reduces political and technical risk.

- Platforms like EveryCRED provide the credential rails, interoperability, and governance capabilities so states can focus on outcomes and trust.

- States that treat wallets as a strategic identity and credential layer in 2026 will set the benchmark for secure, user-friendly digital government for years to come.

States that move now, thoughtfully and with the right partners—will not only modernize identity but unlock a new, trusted interface between citizens and the public sector.

When you are ready to move from exploration to execution, book a 45-minute State Wallet Readiness Session with the EveryCRED team. In that session, you can map your 12–18 month roadmap, identify pilot candidates, and understand exactly how a standards-based wallet ecosystem can be delivered in your context.

16th December, 2025

16th December, 2025